Unclaimed: Are are working at Brex ?

Brex Reviews & Product Details

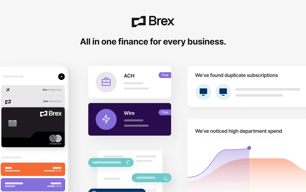

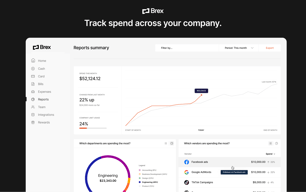

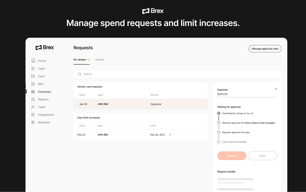

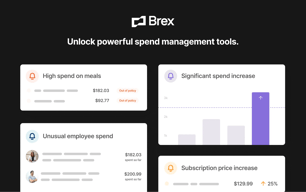

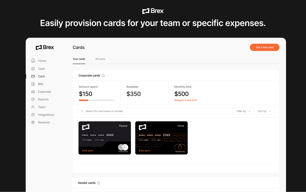

Brex is a financial services platform built especially for startups and small businesses. The software allows users access to expense management tools and even the use of corporate credit card and rewards programs so businesses can manage finances more efficiently and save money through rewards and discounts on business expenses.

| Capabilities |

API

|

|---|---|

| Segment |

Small Business

Mid Market

Enterprise

|

| Deployment | Cloud / SaaS / Web-Based, Mobile Android, Mobile iPad, Mobile iPhone |

| Training | Documentation |

| Languages | English |

Compare Brex with other popular tools in the same category.

The interconnection between SMS and platform. It makes it very easy to file and document expenses.

I don't think i have one by one, I have been using it for less than 5 months. All good so far.

Reduce time to reimburse the money. With other systems, the company would need to invest much time in reimbursements.

Upon using the platform and services, I must say that it was fantastic when times that there was a problem in a transaction, the Brex team never fails to deliver excellent service and support. They always make sure that for every transaction that has a problem, they have a solution and provided it to me.

Hopefully that there will be a much easier procedure in regard to the international transaction so the customer/client would be easier for them to process with a piece of minimum information and requirements.

Pending transactions, the Brex team always provides excellent service by giving you details information and specific solution to understand the situation and trough the solution given, it benefit us as well the customer to accomplish the needed task to be done.

Customer service is great and they have the best web and mobile user interface.

I dislike the rewards and travel options

Making it easier to take a snapshot of our expenses

The thing I like most about Brex is the simplicity, everything you'd need is included in the app. Especially when Brex cards are needed to be added to services/apps. Everything is right in front of you and I like being able to send memos via text.

No downsides initially, have not encountered issues thus far!

Brex is solving our corporate expense accounts and makes managing this a breeze

Very easy and convenient. You can connect multiple users and team members, which makes the business process more efficient

The transactions are a bit confusing, especially trying to find all payment transactions

One platform for finance management

Text messages for Memos are very helpful and easy to use. I must say, using my Brex card is easy and reliable when making purchases. I would recommend to any friend or collegue..

Sometimes it can be difficult to request a receipt for everything and uploading one when one is not needed can be complicated at times. The alerts are annoying at times.

When flying to the airport and using during our stay, it is most problematic when having to upload every receipt that we spend our Brex card on. Sometimes that can be annoying to me.

User-friendly interface. Easy to see the spending of employees. Rewards for travel make things very easy.

Sometimes it takes a while to send the confirmation code to my phone to log in.

Makes the spending in my company very easy to manage. We are located worldwide so Brex has really made things very easy! Day-to-day spending is controlled and easy to follow. The rewards points are great when planning company travel

The convenience and ease of using tools and services provided by Brex to carry out transactions are fantastic.

The only downside of using Brex is if your business is broke.

Brex is helping to solve enterprise business problems especially with card corporate cards.

Brex is very easy to use, and not complicated.

I haven't encountered any problems since I started using Brex.

Brex helps me pay for company expenses, I don't have to bother other members of the team to ask the company credit card

Everything is simple and clear. Quick answers from the support team. You can see all the expenses.

Sometimes payments are pending for too long.

No need to approve additional expenses as I already have a monthly sum on my account.