QuickBooks Desktop Pro Reviews & Product Details

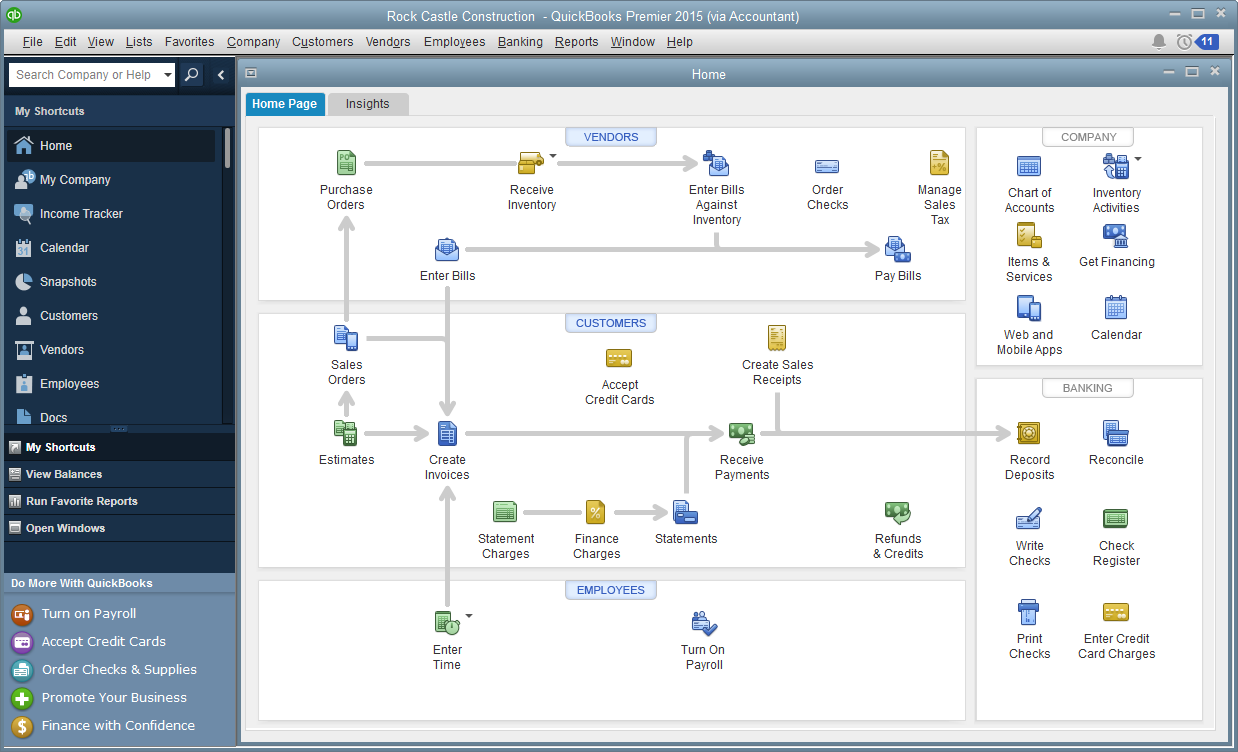

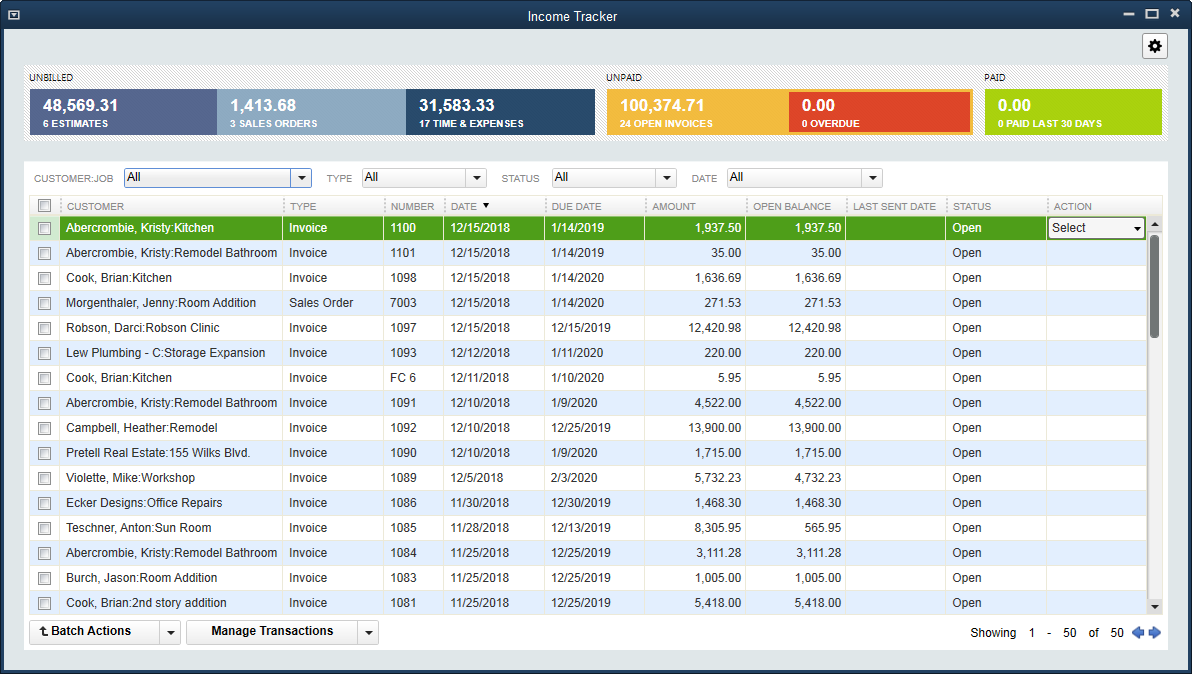

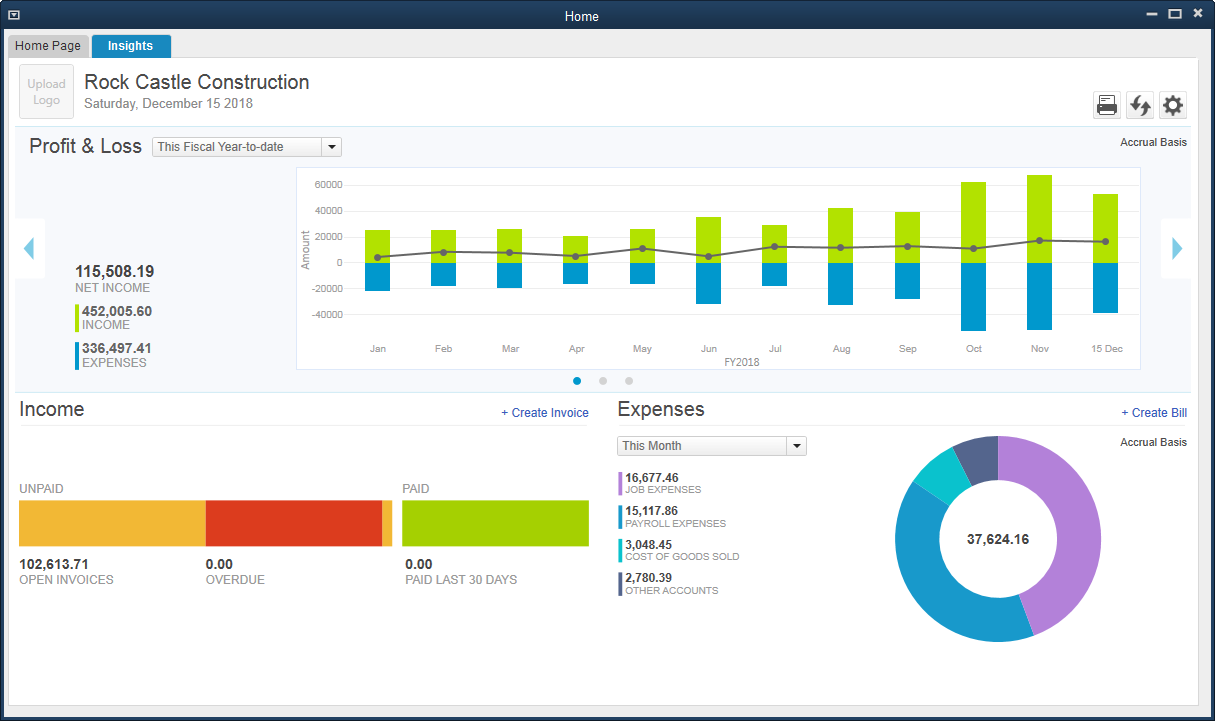

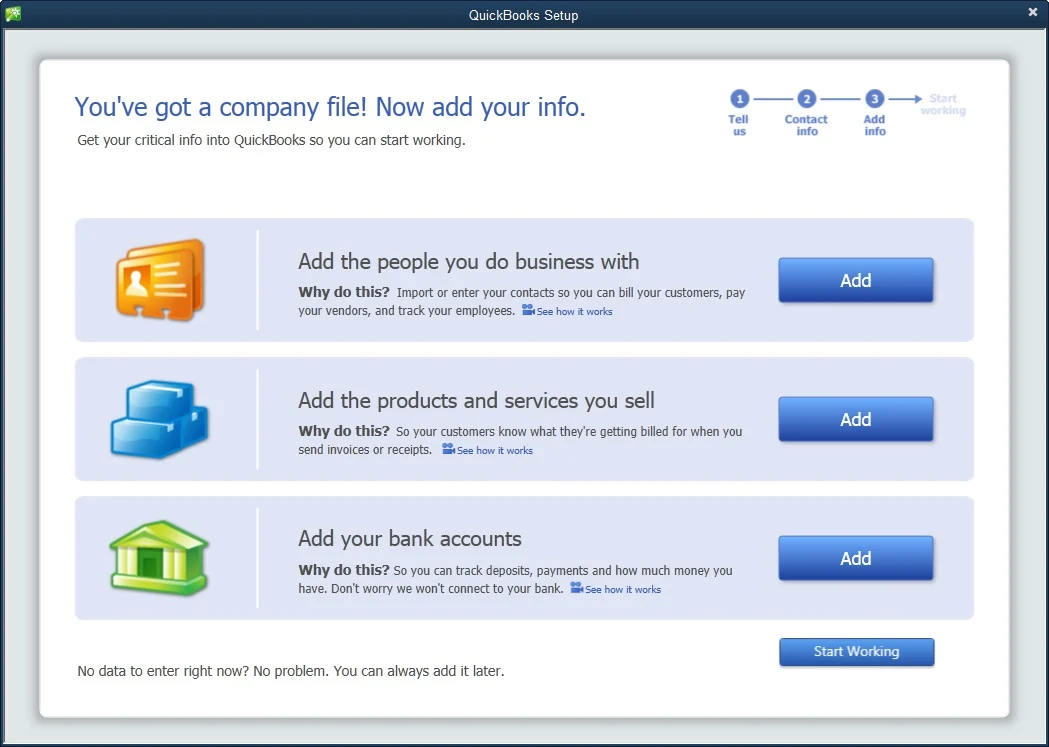

QuickBooks Desktop Pro is a platform that lets users automate key processes in the accounting system, including billing and invoicing. With Desktop Pro, users have the option to link bank accounts, define workflows, and make automated payments for efficiency. This solution also lets users manage employee payrolls via a single application. Other key features include business expense tracking, report generation, and time tracking.

| Capabilities |

|

|---|---|

| Segment |

|

| Deployment | Cloud / SaaS / Web-Based, Desktop Windows, On-Premise Windows |

| Support | 24/7 (Live rep), Chat, Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support |

| Training | Documentation |

| Languages | English |

Overpriced and there is no training available through quickbooks. Trying to cap out sales tax, simple enough. Well not for quickbooks

If I knew that the program would be this obsolete I would have never purchased it. Complete waste of money for the few features it comes with

None, I’ve had to use other programs in place of quickbooks because quickbooks is inadequate.

I use Quickbooks for Mac 2016 to track finances for eight LLC’s that contain real estate investment property. Each entity must be treated as a separate company in QB for bookkeeping and tax purposes. I have used the product for years with general success. It has broad functionality, but the Mac version sometimes has bugs.

Intuit has announced the discontinuation of support for the desktop version for the mac starting in May of 2019. Converting to QB online would require me to purchase eight separate subscriptions. My accounting methodology utilizes the of ‘classes’ feature in QB, therefore requiring me to subscribe to the PLUS version. Total cost would be $50 x 8 companies x 12 months = $4800 annually. When I expressed concern to Intuit, they offered the following options: 1. Get rid of my Mac and buy a PC 2. Stop upgrading my Mac from OS and stay with OS High Sierra forever I see only two solutions that Intuit can offer to avoid alienating a broad section of the Mac community: 1. Reverse this new policy and continue upgrading and supporting QB for Mac 2. Offer a commercial solution by offering deep package discount for users like me would need multiple subscriptions of QB online.

Comprehensive book-keeping capability.

I did notice that the newest interface is nice and clean.

I have never found the customer service to be either quick or helpful.

The business problems it's supposed to solve...this seems like an odd question.

Ease of printing checks, simple reconciliation process.

Retainers are a nightmare, cant print invoices with outstanding balance or remaining credit automatically included, has to be handled manually per invoice.

If the bar association didn't require reconciliation in a certain way I'd just do this stuff by hand. Eventually the client got annoyed with quickbooks and switched to payment upon completion with no downpayment. Problem solved.

I like that quickbooks syncs to online accounts.

I don’t like that there isn’t a cloud service.

N/a

Well designed software customizable for those of us with multiple businesses.

The cost to maintain up to date versions is ludicrous.

Business financial management is customizable. Quick graphic analysis is easily obtained.

This makes our vendors lives easier but it doesn't make our lives easier. Our whole cash flow is manually enter and we can easily miss things. Quickbooks needs better APIs so we can tie to easier to our own in house tools. They need a better software support team that will care about your growth and your sucess but there isn't any.

I dislike everything about it but I don't think it's the software to blame but my finance department What we need is a tool where it picks up all our data and creates all the invoices that we need. PO, Sales Orders, Invoices need to be sent out to everyone all at once. Not one per person. Slow on-boarding process for customers due to this software.

With this tool? Nothing. Our cash flow is hard to audit and that's dangerious.