Unclaimed: Are are working at QuickBooks Desktop Pro ?

QuickBooks Desktop Pro Reviews & Product Details

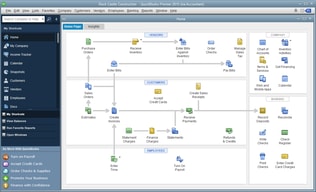

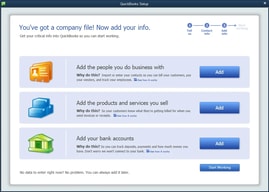

QuickBooks Desktop Pro is a platform that lets users automate key processes in the accounting system, including billing and invoicing. With Desktop Pro, users have the option to link bank accounts, define workflows, and make automated payments for efficiency. This solution also lets users manage employee payrolls via a single application. Other key features include business expense tracking, report generation, and time tracking.

| Company | Intuit Inc. |

|---|---|

| Year founded | 1983 |

| Company size | 10,001+ employees |

| Headquarters | Mountain View, California, United States |

| Social Media |

| Capabilities |

API

|

|---|---|

| Segment |

Small Business

Mid Market

Enterprise

|

| Deployment | Cloud / SaaS / Web-Based, Desktop Windows, On-Premise Windows |

| Support | 24/7 (Live rep), Chat, Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support |

| Training | Documentation |

| Languages | English |

Compare QuickBooks Desktop Pro with other popular tools in the same category.

I like that you only need to pay a one time only fee for this software and not a monthly fee.

This software is local to your computer so it isnt as beneficial if you have more than one user

It is being used as a one stop shop for all of my accounting needs. It is easy to use and set up

Easy to use platform. Both accounting employees in the same office can access files for posting and reviewing.

Honestly, the only dislike is changing my password every so often.

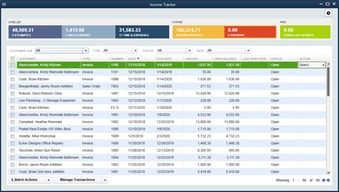

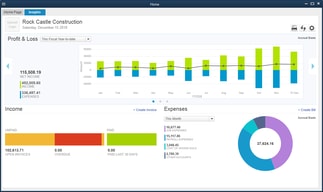

Quickbooks makes reporting easy by class or dates, as needed. It saves us time gathering info.

The most helpful aspect of Desktop Pro is it's robust reporting capacity. From basic, simple financial reports to complex and in depth analysis, this program will never fail to supply what you need.

The speed and frequency of their updates can be a bit of an annoyance. Intuit likes to have updates push through right near month end time, or just as tax season is in full on mode.

I am able to run "CFO" type analysis for my clients through the reporting abilities. The cash flow projections are amazing, provided the client gives you realistic expectations. With the bank and credit card linked uploads for transactions, we are able to typically run a monthly of 800 - 100 transactions in less than 1 hour. This equals real bottom line dollars as we have monthly subscription pricing.

I love the simplicity in the software to create, send and manage invoices.

The only thing that I dislike is that sometimes a report may be off.

I am solving my bookeeping issues, I am able to keep my client accounts organized.

The most liked feature with qbd pro is that it suits the legacy users who are not familiar with qbo. Qbd licensing is cost effective when compared to qbo. Qbd extends the support for other external interfaces so that you can transmit the data from any accounting system to pay your invoices.

Qbd always computes the price automatically and hence original data will be lost when transmitting the price from other accounting systems.

Our customers are able to pay their invoices using qbd seamlessly. They can also view their credits.

The software is quite user friendly. I use the view open windows function for ease of referring to reports, detail, etc. I also like the multiple screen function that is now available. The report capabilities along with generating 1099's at the end of the year are great time savers.

I wish we could reclassify transactions with this software, just as we are able to do when using the Accountants version.

I provide multiple clients monthly financial statements in a timely manner thanks for QB Desktop Pro. I am also able to issue annual 1099's in January with ease. I like being able to enter the vendor information including tax id numbers throughout the year.

Accounting tool that provides multi-monitor support and past due stamps through improved cash flow.

Can be expensive and can also get complex when adding a lot of data.

Accounting software for small business. I find it useful for easy bookkeeping.

QUALITY AND COMFORTABILITY OF THE SOFTWARE, VERY EASY TO USE

SOFTWARE SPEED, VERY SLOW AND NOT FAST ENOUGH

COMMUNICATION

Quick books are indeed about being quick: in adding your custom information, creating a template for invoices and shipping lists, adding a company's logo, entering payments, getting a report of your sales. It is easy to set up up things and start working away.Also, good customer support.

I wish there was a way to easily work on multiple invoices at the same time (to have a way of having multiple windows open).

Invoices, entering payment information, managing customers information, generating sales reports.

The simplicity of Quickbooks the software and how easy it is to input everything into each category. We chose this software so we could run multiple companies from one system with an easy way to move between them all and this is perfect. You can move between companies within minutes all on the same program. It works really well for us and out accountants. We can easily see what areas the business is spending more on and produce yearly budgets to keep us on track.

Sometimes I find it can black out and need to be restarted and I am also frustrated at the lack of banks available for bank fees as this would be a real bonus for us. For me there are not many negatives for this software.

We are easily able to monitor our expenditure and income while being able to produce easy to read reports. The real benefits for us are how quickly we can produce mass invoices, this has really reduced my time to do these each quarter.