Airbase Reviews & Product Details

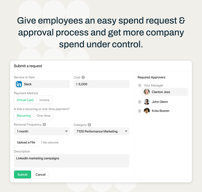

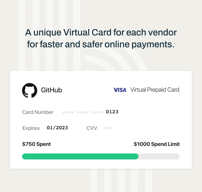

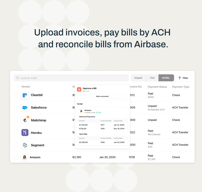

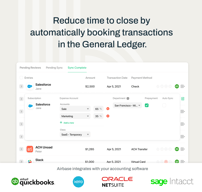

Airbase is a modern finance and expense management platform that automates and streamlines financial processes. It offers a suite of features that include virtual cards, spend management, and real-time expense tracking. Additionally, Airbase integrates with various other business tools such as payroll, accounting, and invoicing systems, making it a one-stop-shop for all finance needs.

| Capabilities |

API

|

|---|---|

| Segment |

Small Business

Mid Market

Enterprise

|

| Deployment | Cloud / SaaS / Web-Based, Mobile Android, Mobile iPad, Mobile iPhone |

| Training | Documentation |

| Languages | English |

Compare Airbase with other popular tools in the same category.

I consider the ability of Airbase to analyze, align and automate spend management best in class. Its tops. Its made procurement, payment, compliance and closing a breeze like never before. its a tomorrow platform! The Ultimate Spend Manager.

Its got everything going for it now. Where it had hitches before, they've been smoothed over dor sure. Reason why its top ranking. No problems with it.

It is a platform that's answering procurement, pay,, spend, compliance and accountability questions. Now more than ever, we're better equipped to navigate those waters.

The visibility of spend all in one place

The requirement to now have upfront deposits in place to fund the card programs

One platform that manages all of our spend and integrates nicely with our ERP. Have automated signature matrix approvals and immediate visibility to all costs at whatever level I want (detailed or consolidated)

I love the ability to create digital card's I like the easy of use, deployment and the user interface The mobile app is helpful for uploading receipt and automatically scanning them. The app clearly shows the status for approval and payment

The receipt upload workflow has a couple more clicks than I would necessary like. Those click add up when I'm expensing things on a trip

Good platform for expense reimbursements

Ease of use! No lengthy training is needed for users -- everything is fairly self explaintory in how to use Airbase. Our company has defined practice policies that we need to be aware of, but outside of that its easy for me to go into the platform to request payment for my programs.

Only feature that is missing, from my view, is a history of approved purchase order requests. I have to dig around for what I'm looking for vs the virtual cards shows a summary of pending, approved, denied, and archived.

Making it easier for users to request, receive approval and make payment for program funds.

My favorite part of Airbase is how seamlessly we have AP integrated into NetSuite. I'm able to process AP quicker than I ever have before. Their expense reimbursement module is also extremely easy to use and saves so much time. I use Airbase all day, every day, and it is my favorite!

The only downside with Airbase is their turn around time for fixing any engineering issues. We receive quick responses from Customer Support, but if the issue requires something on the back end, we do not get very quick response times in that regard.

Airbase has really helped us solve the manual labor issue we had with Procurement. Using Airbase's Procure to Pay module, we have all the contracts and information in one place being approved and revised. It really helps keep things organized all in one place!

The system is easy to use, and the great thing is that we can record 90% of our expenses automatically. Also, we are very happy with the cashback option.

Honestly, I didn't find anything disliking about the system.

Spend Management AP Automation Expense Management Invoice Management / Billing

Easy to use, user freindly, and not bulky

Being able to edit the home page to what I would like to be able to see

Being able to approve expenses and add receipts helps us keep track of our paper trails for automatic payments for the systems we use

Airbase allows me to pay vendors ahead of time. It detects errors rapidly before making payments by matching POs, receivables and invoices. It has a mobile application that has all the features available on cloud-based solution.

Uploading receipts sometimes make the mobile application to buffer mainly when using mobile data.

Airbase makes it a breeze to manage spend, expenses, invoices and vendor in real-time. Controlling finances is made a breeze which help eradicate fraud.

intuitive interface for end users. easy to tell who might be holding up a reimbursement so I know who to follow up with. being able to email the receipt is especially helpful

nothing has stood out for a dislike. no notes

historically getting reiumbursed has taken an eternity. this has been fast and is easy to pinpoint exactly who I need to be following up with if it is taking longer than expected

First, Airbase makes it really simple for folks to review and approve invoices. The A/P streamlining is very good, and also user-friendly on the admin side. That's easily it's biggest strength. The Corporate card feature is pretty useful, as you can create cards on an as-need basis for employees. Another great thing about Airbase is that it's clear they are working on new features and updates constantly. We adopted Airbase in early 2022 and have seen many improvements and quality of life updates throughout it. Customer support is pretty decent overall, and ease of integration was surprisinigly simple.

I would say that currently expense management for employees isn't great, but I know a re-work is being released currently. I would also say that the constant updates, while a good thing, can also make things a little confusing at times if you aren't aware of that changes that they are making. For example, if I run a certain report and manipulate the data into a different spreadsheet to make it easier to read/use, the other spreadsheet has a set format that I created. They often are adding new elements and dimensions into reporting, which make the different spreadsheet have trouble reading the data without making further edits. Still, I'd rather have better reporting and more dimensions than not, so while it's not a bad thing necessarily, it just makes it a little tough at times.

Our A/P process was lengthy and controls were not as strong as they could have been. Fortunately, Airbase has really helped in both of these departments greatly.